The Bitcoin Effect

How to Take Full Responsibility,

Think Long-Term,

and Live Smarter and Happier

with the Mental Bitcoin Operating System

By

Christopher Westra

Add your email below to receive new Bitcoin content as it's written! Learn about sound money and how it can transform your life.

Table of Contents

Creative Commons License and Disclaimer

Introduction - The Bitcoin Operating System

Chapter 1 - Two Things to Remember

Chapter 2 - Take Responsibility

Chapter 8 - Resources (Bitcoin Experts)

Chapter 9 - Resources (Bitcoin Education)

Chapter 10 - Resources (Bitcoin Stats and Charts)

Chapter 11 - Resources (Bitcoin Tools)

Chapter 12 - 21 Specific Problems that Bitcoin Fixes

Bonus Download - The Bitcoin Whitepaper

Bonus Page - 2048 BIP39 Seed Words

Bonus Page - Why Your Seed Words are Safe

Quick link to Bitcoin Solutions (new site)

Creative Commons License and Disclaimer

The Bitcoin Effect byChristopher Westra is licensed under a Creative Commons Attribution 4.0 International License.

This license allows reusers to distribute, remix, adapt, and build upon the material in any medium or format, so long as attribution is given to the creator. The license allows for commercial use.

Please share far and wide! This is written to help educate the world about this amazing freedom technology.

No financial advice is given or implied in these pages. The author of this book has written about his personal experiences with Bitcoin and how the Bitcoin Philosophy has changed his life. Results may vary. The author offers no warranties and shall in no event be held liable for any loss or other damages.

If this book has given you value, please drop me a Bitcoin Tip or a US Dollar Tip on This Page Here. Every dollar helps support the work! You can also contribute to my Geyser Fund here or my Bitcoin Book and Poems Patreon here.

About Christopher Westra

Bitcoin caught Christopher’s attention about 2017 because he saw it was helping people in developing countries. He has been doing microenterprise loans through Kiva at the link below - for many years - 341 loans in 86 countries since 2006. He found that Bitcoin was starting to help in these same countries.

You are invited to help out with Kiva also - click here:

He is also the author of the books listed below and many others.

“I Create Reality - Beyond Visualization: How to Use Holographic Creation to Manifest Your Desires”

“Realms of Joy – Time of Light: How to Live in Holographic Time”

Christopher is also the author of 145 Prosperity Poems and 83 Bitcoin Poems (so far). You can see these at https://ProsperityPoems.com and https://BitcoinPoems.pro

He is married with nine children and three grandchildren, and enjoys writing, hiking, rock collecting, and building rock walls and pathways. With his wife, he enjoys hiking trips to National and State Parks throughout the Western States. Over the years they would like to visit all the United States National Parks.

Join my Patreon here - help spread the love

Support the work - Tip me on Strike

Introduction - The Bitcoin Operating System

“You don’t change bitcoin. Bitcoin changes you.“

Max Keiser

Bitcoin has impacted my life and thought in a powerful way! I noticed that the more I learned about Bitcoin, the more I began to act, and not be acted upon. I began to plan longer term because I knew my money was safe and secure from debasement by my own government.

Day by day I arose more hopeful and happy. I took on physical and mental challenges that I used to whine about or shy away from. I realized that my life was open for me to shape. This all felt very good and powerful, as well as simply productive and efficient.

We need more men and women who can act like strong men and strong women. We have enough victims and whiners and looters, who claim the world owes them.

This is not a technical book about how bitcoin works. I will refer you to some of those at the end of this book.

This is not a book about the details of how to invest in bitcoin. I will refer you to those resources also.

Additionally, this is not a book about how bitcoin helps people in countries who have high inflation, or who live in oppressive regimes, though it does that also.

This is a book about how bitcoin will change YOU, and the personal benefits that you will receive if you adopt the mental bitcoin operating system. I do hope that it will inspire you to search more deeply into Bitcoin.

Here are a few notable people who were also deeply changed by Bitcoin.

Michael Saylor started the software company Microstrategy, and was the CEO from 1989 to 2022. He stepped down from the CEO position to work with Bitcoin and promote adoption. He sees Bitcoin as a way to give economic power and freedom to everyone on the planet.

Another leader is Jack Dorsey, who started Twitter and the payments company Square (now Block). He also stepped down as CEO to work on Bitcoin. Jack said about bitcoin: “I don't think there is anything more important in my lifetime to work on”.

Michael and Jack are both tech engineers and working specifically on lightning, which is a second layer on top of Bitcoin that enables quicker and more private payments.

Farida Nabourema is from Togo and is promoting Bitcoin to free herself and others from abusive monetary systems. In December of 2022, she organized the first Africa Bitcoin Conference. She recognizes that the ability to move money without government control is necessary for freedom.

Roya Mahboob is a software entrepreneur from Afghanistan and the founder of Citadel Software. She was named to TIME magazine’s 100 Most Influential People in the World for 2013 for her work building internet classrooms in high schools. She learned about Bitcoin and discovered that paying her female employees with Bitcoin enabled them to own their own money for the first time.

Samson Mow founded the Canadian video game company Pixelmatic. He now spends his time and energy on Bitcoin, specifically working on Bitcoin adoption by nations. El Salvador is the one example so far, but he is working with other nations also.

Natalie Brunell is an investigative journalist who learned about Bitcoin and attended one of the Bitcoin Conferences. She met some high-profile Bitcoiners and put her journalist skills to work and developed the Coin Stories Podcast, and the Hard Money Podcast (through Swan Bitcoin).

Michael, Jack, Farida, Roya, Samson, and Natalie are simply listed as examples of how Bitcoin can change a person, sometimes so much that they WANT to spend their time promoting it or building upon it.

Most Bitcoiners don’t spend their entire life on Bitcoin. They simply save in Bitcoin and enjoy their usual activities and lives. For me, I write books and attract internet traffic to earn money. And in my free time, I enjoy spending time with family, running and hiking, and building rock walls and pathways.

This book is not financial advice - it’s simply my own thoughts about how Bitcoin has changed the way I think and live!

Though I won’t go into detail about how Bitcoin works, here are some descriptions. Some just call it Freedom Money, and here are the reasons.

Bitcoin is simply software - it’s code. What this code created was a shared ledger of ownership of the coins that make up Bitcoin. This ledger is “shared” because it’s decentralized, meaning that copies of the ledger exist (and are synchronously updated) on thousands of nodes worldwide.

Bitcoin is available and open to all. You literally cannot ban anyone from using it, so it’s permissionless. The record is permanent, meaning that noone can change the ledger, which makes it censorship resistant. You can’t reverse bitcoin transactions.

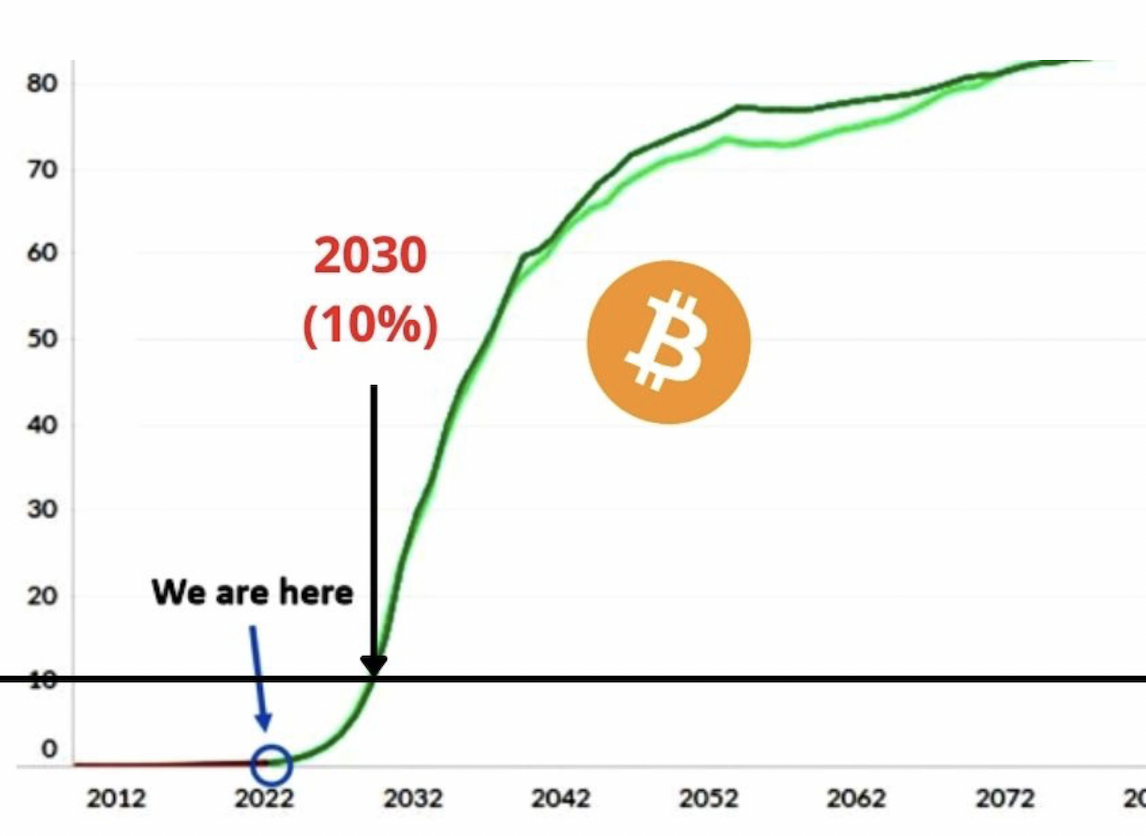

Because it's open to all and useful to everyone who learns about what it can do for them, it's being adopted quickly! However, it's still early. Check out the "We are here" on the chart below (from Bitcoinke.io)

People don’t tend to grasp the revolutionary nature of Bitcoin as quickly if they live in a country where they have a lot of good financial options. They don’t see the usefulness because they are “doing OK” with their current financial system.

However, millions of people in countries with financially oppressive governments see the importance of Bitcoin immediately! The use of Bitcoin spreads quickly in these countries, such as Lebanon, Nigeria, Argentina, Venezuela, and many African countries.

This financial oppression can be outright bans or controls on who can use money, and for what. It can also simply be high inflation, more properly termed debasement of the current value of the money.

So let Bitcoin change you too - and thanks for reading. I’ll end this introduction with Bitcoin Poem 032 - Bitcoin Changes Me. You can see this poem on a background by going to https://BitcoinPoems.pro and clicking on Poem 032. You can sign up on the main page to receive each weekly page as it is written.

Bitcoin Changes Me

Bitcoin increases my clarity

As it shines light and honesty

On what money can truly be

This clarity - it spreads through me

And helps me in my actions see

Those which bind, or set me free

Bitcoin builds my strength of mind

As my incentives get aligned

To hold my assets as designed

And so I find that I’m inclined

To conquer tasks that I’m assigned

And master skills that I’ve outlined

Bitcoin questions the status quo

Of the modern monetary show

To create money on endless flow

This helps me question what I know

Search for truth, and insight grow

These changes does Bitcoin bestow

Chapter 1: Three Things to Remember about Bitcoin

“I think the bitcoiners have been predicting this for a long time. Speaking for all the bitcoiners, we feel like we are trapped in a dysfunctional relationship with crypto and we want out.”

Michael Saylor - Author of “The Mobile Wave”

1. Bitcoin is Not the Same as Crypto

Bitcoin is not the same as “Crypto”, Bitcoin is unique, groundbreaking, and revolutionary. Yes, it now has 22,775 copycats as of today. There will be more tomorrow. I’m not exaggerating - that’s the real number. Some of these cryptocurrencies claim to be shinier and faster and better than Bitcoin.

Most Bitcoiners (myself included) had a phase where they were interested in many coins, and then after much research ended up with just Bitcoin. No other coin is as decentralized. No other coin has as critical a mission as Bitcoin. This mission is to be a secure, un-debaseable, permissionless world reserve asset for everyone. No other crypto project can do that.

I could write an entire book about the differences between Bitcoin and Crypto, but this will have to suffice for now. Be wary of who you listen to. Ask yourself if they have a vested interest in promoting whatever new coin they are telling you about.

Nearly every crypto project is centralized enough that it can be controlled by a few people or a group. This centralization makes it more like fiat money, and different from Bitcoin, even if they happen to use a “blockchain”. See the image below and compare the perception on the left, and the reality on the right. This image is from Alan Watts on Twitter.

Bitcoin is different than crypto

2. Self-Custody Your Bitcoin

It’s not too hard to self custody your Bitcoin. You’ll hear people saying that it’s too difficult. I’m not old, but I am older than your typical Bitcoiner (I’ll turn 57 years old in 2023). I learned how to do it, and you can too.

Basically, this means having your private keys on a hardware wallet that you control - I’ll add some links in the resources to help you. BTCSessions has some great tutorials. In this life you learn how to do things - register a car, open a bank account, get a credit card. Yes, there are some new ideas and you want to do it right, but YOU CAN do it.

The alternative is to buy your bitcoin on an exchange, such as Coinbase, and then leave it there. Then all you really have is an IOU, because Coinbase owns your bitcoin. They may give it to you when you want it, but they may not. I lost bitcoin on Celsius, a company that went bankrupt in 2022, along with FTX, Voyager, and several other major crypto exchanges.

You can believe I learned how to hold my own keys after that! Now I control my finances and not some company who may or may not keep it safe.

As a reminder, your bitcoin isn’t actually “ON” your wallet. That’s a misconception. The bitcoin is always on the Bitcoin blockchain, and your private keys proving your ownership are on the hardware wallet.

3. You are Still Early to Bitcoin!

Here are some stats to show that you are still early to Bitcoin:

Only 2% of the world's population owns Bitcoin. This means that there is still a huge potential for growth in the adoption of Bitcoin.

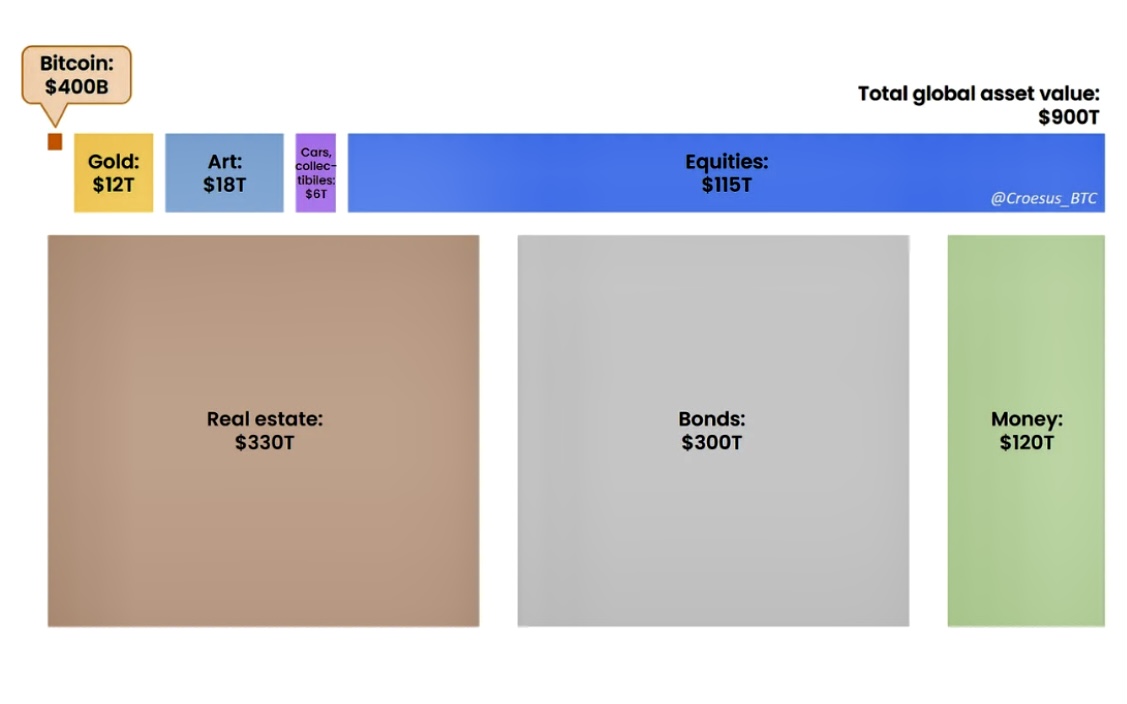

The total market capitalization of Bitcoin is still relatively small compared to other asset classes. For example, the total market capitalization of gold is over $10 trillion, while the total market capitalization of Bitcoin is only around $1 trillion. This means that there is still a lot of room for Bitcoin to grow in value.

Here is a chart from Jesse Myers that shows the value in different asset categories.

Bitcoin is still in its early stages of development. The Bitcoin protocol is constantly being improved, and new applications for Bitcoin are being developed all the time. This means that the potential of Bitcoin is still largely unknown.

Bitcoin is a global currency. It can be used to send and receive payments anywhere in the world. This makes it a very attractive option for people who want to avoid the fees and delays associated with traditional payment methods.

Bitcoin is a scarce asset. There will only ever be 21 million Bitcoin in existence. This makes it a valuable asset that is likely to appreciate in value over time.

Overall, the evidence suggests that people are still early to Bitcoin. The potential for growth in the adoption of Bitcoin is huge, and the value of Bitcoin is likely to continue to appreciate in the future.

Chapter 1 Review Questions

The answers will be at the end of this chapter. Really think about these and commit to an answer!

Question 1: What does it mean to self-custody your Bitcoin?

A) It means giving your Bitcoin to a third-party custodian for safekeeping

B) It means storing your Bitcoin on an exchange for easy access

C) It means keeping your Bitcoin on a hardware wallet that you control

D) It means giving your Bitcoin to a friend to hold for you

Question 2: Why is Bitcoin so unique compared to other Crypto projects?

A) It has the most support from the news media and journalists

B) It has the decentralization necessary to provide a secure and permissionless base level asset for the world

C) It has the fastest transaction speed of any cryptocurrency

D) It has the most advanced smart contract capabilities of any cryptocurrency

Practical Exercise

I’ve got two quick action items here to increase your awareness and self confidence!

1. Google “Bitcoin Hardware Wallets” and take 60 seconds to peruse the results. This is merely to make you aware that they exist and are used by millions of people.

2. Now go to YouTube and enter “bitcoin hardware wallet tutorial” and take another 60 seconds to peruse the options there. You’ve got help when you’re ready to learn how to set up a hardware wallet.

Answers to Chapter 1 Review Questions

Question 1 - Correct answer: C) It means keeping your Bitcoin on a hardware wallet that you control.

Question 2 - Correct answer: B) It has the decentralization necessary to provide a secure and permissionless base level asset for the world.

Chapter 2: Take Responsibility

“Your keys, your bitcoin.

Not your keys, not your bitcoin.”

Andreas Antonopoulos - Bitcoin Proponent

It’s not just about freedom. It’s about responsibility. Bitcoin is “Responsibility go Up” technology. To be a bitcoiner is to be an individual who can balance freedom and responsibility.

Aleksander Svetski

Take Ownership

Let me start with a personal story here. For the past decade I’ve had my taxes done by a tax professional. I thought it was too complicated with my business income and then being into crypto made it even more complex. In early 2023 I wanted to finish up my taxes quickly and off my mind. Tax professionals don’t care if you want to finish up quickly. I had some simple questions and could not get a reply, day after day.

Something inside me just awakened and said, “Just learn it and do it yourself! You are the ONLY person who will get your taxes done on your timeline. Take responsibility!” So I acted on this and in nine hours over two days my taxes were done.

I had to learn a lot - but it felt good to take ownership and commit to my timeline and goals. My tax refunds were in my bank account within the week.

Bitcoin is built on the philosophy of responsibility.

One of the core tenets of Bitcoin is that users have complete control over their own money! Bitcoin transactions are peer-to-peer, meaning there is no central authority controlling the movement of funds. This gives users a greater sense of responsibility over their finances and encourages them to take ownership of their financial decisions.

This is what is meant by the quote by Andreas at the start of this chapter. Here it is again.

“Your keys, your bitcoin.

Not your keys, not your bitcoin.”

Andreas Antonopoulos - Bitcoin Proponent

Bitcoin is decentralized, meaning it is not controlled by any government or financial institution.

Power and Responsibility

This gives users the power to be their own bank and make financial decisions without the influence of external parties. With this power comes greater responsibility, as users must take the time to educate themselves on how to properly manage their funds and protect themselves from potential risks.

When you hold your own money, you do that with some code words that are called “keys”. Your Bitcoin always remains on the Bitcoin Blockchain, and your KEYS prove that you can access it, and move it or spend it when you wish.

Bitcoin's cryptographic security measures provide users with a high degree of protection against fraud and theft. However, users are also responsible for keeping their private keys safe, which are required to access their funds. So Bitcoin owners need to take responsibility for the security of their own assets and practice good security habits.

Bitcoin's blockchain technology provides a transparent ledger of all transactions, which can be viewed by anyone. This makes it difficult for users to engage in fraudulent or illegal activities without being caught. The transparency of Bitcoin also encourages users to take responsibility for their actions and make ethical decisions.

So as I found in my own life, the philosophy behind Bitcoin promotes personal responsibility by giving users control over their own finances, promoting security, and fostering transparency.

Many of us live in countries with “caretaker” institutions and they do provide benefits in some ways. However, this has also made us weaker and more vulnerable as we hand over more and more of the ownership for our own lives.

Chapter 2 Review Questions

The answers will be at the end of this chapter. Really think about these and commit to an answer!

Question 1: Which of the following statements accurately describes the decentralization of bitcoin?

A) Bitcoin is owned and controlled by a single organization

B) Bitcoin transactions are processed by a centralized authority

C) Bitcoin is subject to government regulations and interventions

D) Bitcoin is maintained by a network of users and nodes

Question 2: Which of the following statements accurately describes how Bitcoin promotes personal responsibility?

A) Bitcoin allows users to remain anonymous and avoid accountability for their transactions.

B) Bitcoin transactions can be easily reversed, making it less important for users to be careful with their money.

C) Bitcoin encourages users to secure their own private keys and be in charge of their own funds.

D) Bitcoin relies on a central authority to manage and protect user funds.

Practical Exercise

Ask yourself which areas of your life you take full responsibility for? Write down three areas or aspects of your life where you feel good about your level of ownership?

1. ____________________________________________________

2. ____________________________________________________

3. ____________________________________________________

Now, which areas of your life do you need to increase responsibility for? This could be a large area of your life, for example Finances or Health Care. Or it could be a specific project, as in my case - Fix the broken sprinklers! Write down at least three below.

1. ____________________________________________________

2. ____________________________________________________

3. ____________________________________________________

Answers to Chapter 2 Review Questions

Question 1 - The correct answer is D) Bitcoin is maintained by a network of users and nodes.

Question 2 - The correct answer is C) Bitcoin encourages users to secure their own private keys and be in charge of their own funds.

Chapter 3: Think Long-Term

“Sound money allows people to think about the long term and to save and invest more for the future. Saving and investing for the long run are the key to capital accumulation and the advance of human civilization.”

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

Time Preference

You may or may not have heard of the term “Time Preference”, but you’ll understand the principle.

High time preference thinking and planning is more concerned with the needs of the present moment. Low time preference thinking delays present gratification and places more emphasis on future needs, and planning long term.

I think it’s more clear to say short term time preference and long term time preference, but hey, I didn’t make up the terms. Fiat money with high inflation encourages people to focus on the present needs because their money is losing value. It’s hard to plan long term when you can’t store your wealth in anything where it will keep its value.

High time preference people are not very disciplined, and if you look around you can see this in most societies today. For a person (or a family, or society), to achieve big dreams and large goals requires that you plan and think long term. This often means working for years, and sacrificing some short-term pleasures.

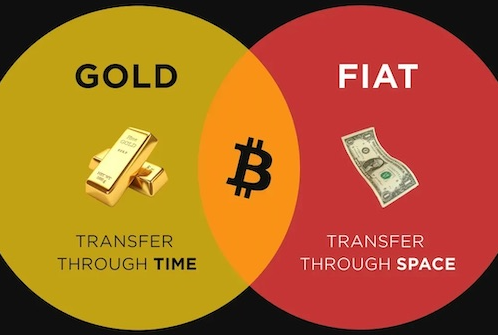

Check out the image below. Gold was good at transferring value through time, but not so portable. Therefore, gold was not ideal for transferring value across the world. Fiat was built on top of gold originally (when we were on the gold standard), and it helped fix gold's portability problem. However, it led to many other problems.

Bitcoin can transfer value across time AND across space, and doesn't have the drawbacks of fiat.

How Bitcoin Helps You Think Long-Term

Bitcoin has a fixed maximum supply of 21 million coins, which makes it a deflationary currency. Because of these unique properties, bitcoin can inspire long-term thinking in a person in several ways:

The main way is simply by saving in Bitcoin; Its finite supply and its potential to increase in value over time can encourage people to invest in it for the long term. This approach requires patience, discipline, and a long-term mindset. Bitcoiners often talk about how this mindset starts to influence every area of their life, and not just finances. When people complain about the volatility of Bitcoin, they are simply looking at it within a short time frame.

Bitcoiners who have mentally adopted a long-term view remain confident in its long term growth despite price volatility.

Building on the Bitcoin network also requires a long term view. Bitcoin's decentralized nature and open-source code make it possible for people to build applications and services on top of the Bitcoin network. This approach requires a long-term vision for the potential of the Bitcoin network and the willingness to invest time and resources to develop new ideas. Those who commit to building on Bitcoin start to think more long-term in many facets of their lives.

Education and Adoption: Bitcoin's complex technology and its potential to revolutionize the financial system require education and advocacy to help people understand its benefits. This approach requires a long-term perspective on the potential impact of Bitcoin and the willingness to invest time and effort in educating others.

I feel called to help in this education process with my Bitcoin Poems and this book.

Overall, Bitcoin's unique properties and potential for growth can inspire long-term thinking in individuals who are willing to invest their time and resources in it.

Chapter 3 Review Questions

The answers will be at the end of this chapter. Really think about these and commit to an answer!

Question 1: Which of the following is a way that Bitcoin helps you think long-term?

A) Encourages short-term thinking and impulse buying

B) Provides instant gratification and quick profits

C) Discourages investment and savings

D) Inspires holding for the long-term, regardless of short-term price fluctuations

Question 2: Which of the following best describes an advantage of thinking and planning long term?

A) It allows you to focus only on short-term gains

B) It can lead to better decision-making and risk management

C) It can limit your opportunities for growth and development

D) It increases the likelihood of impulsive decisions

Practical Exercise for Long Term Thinking

Write a ten years in the future letter to someone. Before I started my business in 2005 I worked as a counselor in a troubled youth facility and in a prison. I’ve had thousands of these youth and adults write a ten years in the future letter. It really makes you think about what you want!

Get a piece of paper. Think of someone to write to, and add their name, and the date.

For example, “Hey Brian, it’s been a long time and it’s now 2033. Let me catch you up on my life for the last ten years.”

Dream big, and describe some of what you want to accomplish, but in the letter it should be written in the past tense, as if you’ve already accomplished it.

For example, “I started my catering business in 2025 and I’ve got 20 employees now. It’s doing really well financially.” or “Cherise and I moved to our ranch in 2024 and then in 2025 some other family members came here and built a cabin near us. It’s so nice to have space and freedom to do what we want.”

Technology is advancing at an incredible rate, so feel free to throw some futuristic ideas or tech in your letter also.

Once you have this vision - you’ll find that it draws the situation and people who can help you achieve it. You’ll find your behavior changing naturally also.

But it can also help to consciously do some backcasting. Yes, that’s really a word. Backcasting is when you start with a desired future outcome and work backward to identify the steps needed to achieve that outcome. This exercise can help you develop a long-term strategy and identify potential obstacles along the way.

Answers to Chapter 3 Review Questions

Question 1 - Correct answer: D) Inspires holding for the long-term, regardless of short-term price fluctuations

Question 2 - Correct answer: B) It can lead to better decision-making and risk management.

Chapter 4: Live Smarter

“According to Cantillon, the beneficiaries from the expansion of the money supply are the first recipients of the new money, who are able to spend it before it has caused prices to rise. Whoever receives it from them is then able to spend it facing a small increase in the price level.

As the money is spent more, the price level rises, until the later recipients suffer a reduction in their real purchasing power. This is the best explanation for why inflation hurts the poorest and helps the richest in the modern economy.”

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

Critical Questioning

Bitcoin is a new technology that requires a certain level of understanding and critical thinking to grasp. Nearly all Bitcoiners notice that over time, they start to think more clearly in other areas of their lives as well as finance! This doesn’t mean that we have a monopoly on the truth, but Bitcoiners are much more likely to question things and think critically.

As you learn that Bitcoin is sound money because its issuance is known and capped, you see clearly that fiat money is not sound and that freely printing more of it causes debasement of the currency. You simply see things more clearly.

When you start to learn about how the current money system favors those in power and other rich people, you start to question what you’ve been taught about finances. And as you question what you’ve been told about money, you start to question what you’ve been told is true about education itself, the news media, food, health, priorities, government programs, and much more.

Just in finances, you start to see that the current money system favors those in power in several ways:

1. Wealth inequality: The current money system often results in wealth inequality, where a small group of people control a disproportionate amount of wealth and resources. This gives them more power and influence over the economy and society, allowing them to shape policies and decisions in their favor.

2. Access to capital: Those who have access to capital can invest in businesses and assets that generate more wealth, creating a cycle of increasing wealth and power. However, those who lack access to capital are often left behind and unable to participate in the same opportunities.

3. Control over financial institutions: Those in power often have significant control over financial institutions, such as banks and investment firms. This allows them to influence lending practices and investment decisions, potentially benefiting themselves and their networks.

4. Political influence: Wealthy individuals and corporations can use their financial resources to influence political decisions and policies, often to their own benefit. This can give them an unfair advantage over others who lack similar resources.

Overall, the current money system can create and reinforce power imbalances, favoring those who already have money. Bitcoin, on the other hand, is a great equalizer. It’s true that some people who adopted it early have more bitcoin than others, but that doesn’t mean that they can change the rules in their favor!

Since Bitcoin is a controversial topic and some groups have an incentive to maintain the current money system, there exists a lot of misinformation and FUD (Fear, Uncertainty, and Doubt) surrounding it. Learning to analyze information critically and make informed decisions based on facts and evidence can help you navigate complex issues in all areas of your life.

Bitcoin Exposes Incentives

Bitcoiners have a common saying “Bitcoin exposes incentives”, meaning that it helps you see more clearly through propaganda and fake news because incentives are more clearly seen.

You can also see other people’s incentives more clearly. For example, Jamie Dimon, CEO of JPMorgan Chase, doesn’t like Bitcoin. That’s expected - he’s made his money in the traditional fiat system and the Cantillon effect has been his good friend! The Cantillon Effect is described in the quote at the beginning of this chapter. He has every incentive NOT to accept Bitcoin but to further the present monetary system.

Jamie famously questioned how Bitcoiners know that there will only be 21 million bitcoin on the network. For such a smart man, it’s a silly question. It’s OK to ask, but there is an answer, which is that it’s governed by code and math. That comment revealed how disingenuous he is, because with five minutes of real study he could find the answer. He didn’t throw out the question because he’s open to the answer, he threw it out because he wants to sow doubt in people’s minds.

I can answer Jamie’s question, and he could connect with any of the experts listed in the resources who can answer it better than I could.

The Bitcoin Nexus

A nexus is a central point that ties things together.

Bitcoin does take a bit of understanding because it’s at the nexus of technology, history, economics, politics, computer science, finance, cryptography, forms of government, game theory, physics, energy, engineering, and more.

You don’t need to be an expert in all these to understand Bitcoin. However, people who start to learn seem to be drawn ever deeper down the “rabbit hole” of Bitcoin, as Bitcoiners commonly say.

Overall, learning about Bitcoin can help you develop a range of skills and knowledge that can be applied to other areas of your life. It requires a certain level of curiosity, critical thinking, and a willingness to learn, which are all valuable skills to have in any area of your life.

Chapter 4 Review Questions

Question 1: What does it mean that Bitcoin exposes people's incentives?

A) It reveals what people want to buy with Bitcoin

B) It shows how much Bitcoin someone owns

C) It exposes the motivations behind everyone’s actions

D) It allows people to anonymously use Bitcoin

Question 2: How does the current money system favor those in power?

A) They receive the new money first due to the Cantillon Effect

B) Those in power have some control over financial institutions and policy

C) Wealthy people can use resources to influence legislation to their benefit

D) All of the above

Practical Exercise for Living Smarter

Your exercise for thinking smarter is to increase the breadth of your worldview. For example, I subscribe to one newsletter that might be considered “far-right” here in the United States. And I subscribe to another newsletter that is more “far-left”.

I don’t take time to read them all the time, but I do here and there and it keeps my mind open and working and not simply listening to those who already agree with me on issues. The different way they can interpret the same event is mind-expanding!

Consciously seek out different sources of news and opinions than your usual, NOT to blindly accept what they say but to learn and think.

Try and see the “narrative” that is maintained by your usual sources of media (and others you seek out). Think through the message and the possible incentives.

Answers to Chapter 4 Review Questions

Question 1 - Correct answer: C) It exposes the motivations behind everyone’s actions

Question 2 - Correct answer: D) All of the above

Chapter 5: Live Happier

“Money is a technology that allows us to imagine futures,”

Aaron Swartz - Tech Genius and Entrepreneur

“Sound money is also an essential element of a free society as it provides for an effective bulwark against despotic government.”

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

Agency and Hope

Money enables us to transfer value into the future. So the better our money holds its value, the better future we are able to imagine. So it’s natural that people storing money in Bitcoin - the hardest money on earth, will be hopeful and happier overall.

Bitcoin's finite supply and decentralized nature make it a form of “hard money,” meaning its value is more stable over time than government-issued currencies, which is predictably subject to inflation and other economic factors. During the Covid pandemic, and since, governments have gone on a spending spree unlike any other in history, and the resulting inflation is now surging!

Bitcoiners who are convinced of the security of Bitcoin may feel more secure about their financial future because they have a decentralized asset that can hold value over time. This may give them a sense of control and certainty that can contribute to their happiness. I find Bitcoiners very positive about the future because they have this hope.

Additionally, Bitcoiners may feel a sense of community and shared values with other Bitcoin users, which can contribute to a sense of belonging and happiness. The Bitcoin community is known for its emphasis on privacy, individual liberty, and financial freedom, and Bitcoiners often feel empowered by their involvement in this community. Bitcoin is NOT a religion, but it can be compared to one because of the dedication to a cause and the depth of the social community.

Furthermore, the act of investing in Bitcoin (and educating others about it) may give Bitcoiners a sense of purpose and accomplishment. By investing in Bitcoin, they are taking control of their financial future and making decisions that they believe will benefit them (and those who listen to them) in the long run.

This can give them a sense of agency and satisfaction, which can contribute to their overall happiness. The benefits of investing in Bitcoin, such as financial security, community, purpose, and agency, seem to contribute to their overall sense of happiness and well-being.

When you have true control over your money, you have true control over your life. When you use money that can be censored or taken from you, and is taken from you regularly through inflation, you tend to be much less hopeful about the future! When your hope is low, and your future is less certain, your happiness level drops also.

Bitcoin Gives You Time

Because you know your money is securely saved in the hardest asset the world has known (since no more can be issued after 21 million), this can free your time for your favorite activities. When suffering from a high yearly inflation rate, everybody is forced to spend their time learning how to “keep up” with inflation. In some countries, this is nearly impossible.

Some people keep up with inflation by getting a second job or working longer hours. Others who already have money saved are forced to become an expert in investing so they can earn a yield that matches inflation. Historically, the stock market goes up at about the same rate as the money supply, so people have to become skilled at investing in stocks.

Bitcoiners love their hobbies and life activities! For me, this is spending time with my family, hiking, rock collecting, and building rock walls and pathways.

Life is about more than work, though Bitcoiners do appreciate work. Give value to the world and earn money in return, save in Bitcoin, and then let it go up in value when you have a long enough time frame. Then you can free up the rest of your life for living. For you, that might be cooking, rock climbing, horseback riding, surfing, or whatever.

Those who understand Bitcoin deeply don’t think in terms of “buying” bitcoin with dollars as an investment. They think in terms of moving value from dollars (which are 99% guaranteed to go down over the years) into a different money system called Bitcoin, which is 99% guaranteed to go up over the years.

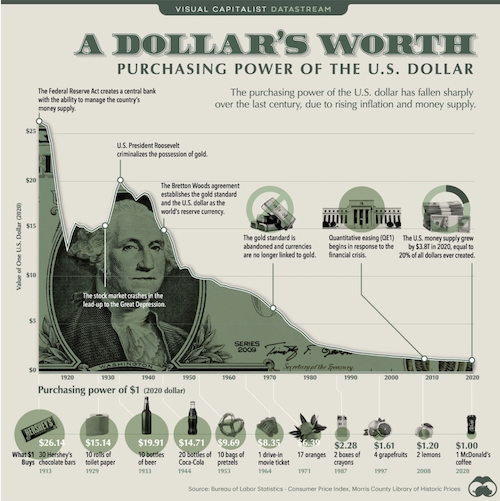

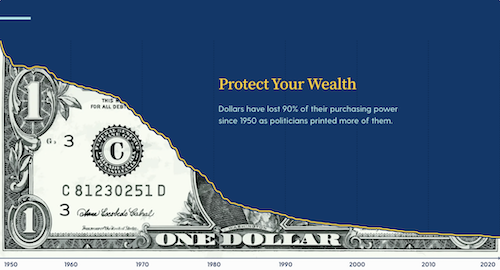

Don't you think you'll be happier holding your value in Bitcoin when the overall trajectory is up? See the chart below, from @therationalroot on Twitter. Or would you rather have the value of your savings go down, as shown on the other image below? The second image is from The Visual Capitalist.

Chapter 5 Review Questions

Question 1: How can using Bitcoin lead to greater happiness?

A) Investing in Bitcoin guarantees financial success and therefore leads to greater happiness

B) Bitcoin’s flexible money supply means that more can be printed - and that’s more for everybody

C) Bitcoin’s hard money status helps people move value to the future and thus plan for it more hopefully and securely

D) Bitcoin’s leader says you’ll be happier and you can trust that it’s true

Question 2: Which of the following best explains how Bitcoin can free up your time?

A) By requiring you to become an expert in investing to earn a yield that matches inflation

B) By allowing you to save your money in a secure and inflation-resistant asset, freeing up time for hobbies and activities

C) By forcing you to work longer hours or get a second job to keep up with inflation

D) By requiring you to constantly monitor the value of your Bitcoin investments to avoid losses

Practical Exercise for Living Happier

List 5 favorite activities that you’d like to do more of when you have more time.

1___________________________________________________

2___________________________________________________

3___________________________________________________

4___________________________________________________

5___________________________________________________

Answers to Chapter 5 Review Questions

Question 1 - Correct answer: C) Bitcoin’s hard money status helps people move value to the future and thus plan for it more hopefully and securely

Question 2 - Correct answer: B) By allowing you to save your money in a secure and inflation-resistant asset, freeing up time for hobbies and activities

Chapter 6: Live Free

“Bitcoin's mere existence is an insurance policy that will remind governments that the last object the establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.”

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

“This is a historical lesson of immense significance, and should be kept in mind by anyone who thinks his refusal of Bitcoin means he doesn't have to deal with it. History shows it is not possible to insulate yourself from the consequences of others holding money that is harder than yours.”

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

Bitcoin Increases Freedom

The decentralization of Bitcoin promotes freedom from government or financial institution control, enabling individuals to have greater financial sovereignty and independence in many ways.

Financial Inclusion: Bitcoin offers an alternative financial system that is accessible to anyone with an internet connection. This makes it particularly valuable for individuals who do not have access to traditional financial services or are excluded from the banking system. Bitcoin promotes freedom by giving people the ability to participate in a global financial network without requiring them to have a bank account or meet specific eligibility requirements.

Inflation Resistance: Bitcoin's finite supply of 21 million coins makes it resistant to inflation, unlike traditional currencies that can be subject to inflationary pressures. This means that the value of Bitcoin is likely to go up over time (rather than down like fiat), giving individuals greater financial freedom and security.

Borderless: Bitcoin operates globally and is not restricted by national borders or currency exchange rates. This means that individuals can send and receive funds to and from anywhere in the world without intermediaries. Bitcoin promotes freedom by eliminating the barriers that traditional financial institutions impose on cross-border transactions.

Privacy: While Bitcoin transactions are not completely anonymous, they do offer a level of privacy that traditional financial transactions do not. Users can transact without revealing their identity, which can be beneficial in situations where privacy is essential, such as political or social activism. Privacy is NOT a crime, and most Bitcoiners claim that you cannot even have freedom without privacy.

Matt ODell and Bitcoin Magazine have produced an excellent video series called “Freedom Money” and you can view the second of the series below:

The Freedom Mindset - Bitcoin and Human Rights

When you realize that you can obtain financial freedom, this spills over into every area of your life, which feels empowering! You feel more free to question what you’ve been programmed to believe and how you are “supposed” to live.

According to Freedom House, a human rights organization, nearly 3 billion people live under authoritarian regimes. Authoritarian leaders just hate it when the masses won’t lie down and do what they are told to do. Andreas Antonopoulos tells about how a group of Chinese protesters were tracked down by the authorities through the use of their subway card.

If you live in a free economy where your basic rights are protected, then you might see Bitcoin as a speculative asset, and miss the revolutionary nature and possibilities. This is true also if you have decent access to financial services and your national fiat money is somewhat stable.

It’s quite different when you live as one of the 3 billion who don’t have these luxuries. Yet even in countries we thought were more free, financial oppression is now occurring. JPMorgan Chase closed Kanye West’s bank account without giving a reason, because he said something they didn’t agree with.

During the Freedom Convoy, the Canadian government froze donations to protesters when these payments were done through the usual financial rails. So the supporters of the convoy started to use Bitcoin, which the government couldn’t block, freeze, or confiscate.

Bitcoin grants everyone on earth the right to own property that can’t be debased by the government. Fiat money is subject to this theft of value nearly every year, and is significant over time even with a “low” inflation rate!

With Bitcoin, you have the freedom to transact peer to peer with anyone you want, with no permission needed. Authoritarian governments can seize your fiat money for any number of reasons when they feel the desire, because of your skin color or religion, your heritage, or simply because you are speaking up for freedom.

Chapter 6 Review Questions

Question 1: What is one way that Bitcoin promotes freedom?

A) By promoting government and financial institution control

B) By requiring individuals to have a bank account to participate

C) By subjecting the users to inflationary pressures

D) By enabling individuals to have greater financial sovereignty and independence

Question 2: What is one way in which Bitcoin can increase human rights?

A) By providing a speculative asset for investors in free economies

B) By enabling authoritarian governments to track financial transactions more easily

C) By allowing people to transact without permission and without fear of government seizure

D) By offering stable fiat money to those living in countries with financial oppression

Practical Exercise for Living Free

Buy some bitcoin. Simply get some to start with. As some Bitcoiners say, “Get off zero”. Even if it’s just a few dollars, it’s a psychological start for you! If you are a beginner, then just buying bitcoin may be a huge step, even if it’s through a third party like Fidelity or an exchange.

However, remember that the ultimate goal is for you to hold your own money and NOT trust a third party. So if you already have some bitcoin purchased and it’s not in your own wallet, your action item is to move SOME of your bitcoin into a wallet controlled by YOU.

I promise that after you move a little bit and feel comfortable with it, you’ll enjoy the safety and freedom you feel. If you need to do some research first in order to understand what you are doing on a hardware wallet, then do that research.

Answers to Chapter 6 Review Questions

Question 1 - Correct answer: D) By enabling individuals to have greater financial sovereignty and independence.

Question 2 - Correct answer: C) By allowing people to transact without permission and without fear of government seizure

Chapter 7: Hard Money

This is a historical lesson of immense significance and should be kept in mind by anyone who thinks his refusal of Bitcoin means he doesn’t have to deal with it. History shows it is not possible to insulate yourself from the consequences of others holding money that is harder than yours.

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

Hard Money Dialogue

The interchange below is a pretend dialogue, but made up of parts of conversations I’ve had with people over the last few years.

Friend: You and other Bitcoiners are always talking about “hard money”! What is hard about money and why would I want it?

Bitcoiner: Good question. I think I can explain it but I have one caveat first.

Friend: OK, what’s the caveat?

Bitcoiner: It’s just about definitions. It can be confusing because if you search “hard money” in Google you get results about hard money in lending and in politics.

Friend: So that’s not what you Bitcoiners mean?

Bitcoiner: Not at all. We mean the original use of hard money which is hundreds of years old.

Friend: And what’s that?

Bitcoiner: Well, what has been used for money more than anything else, over the centuries?

Friend: Gold I suppose; gold and silver.

Bitcoiner: Yes, and metal is hard, depending on the metal. .

Friend: It can’t be that simple. Bitcoin isn’t even physical. It can’t be hard in that way.

Bitcoiner: You’re right. In fact, people used to bite their gold coins to see if they were soft, to try and see if they were gold.

Friend: I’ve seen some Olympic medalists bite their awards.

Bitcoiner: Yes, but gold isn’t valuable because it’s either soft or hard in that way. Steel is much harder, so would it be better for use as money? What makes gold special?

Friend: Gold is scarce.

Bitcoiner: Right, it’s valuable because it’s scarce. Money also needs to be durable, meaning long lasting. And ideally, money is portable, divisible into small units, and easily verified to be authentic.

Friend: That’s a lot.

Bitcoiner: OK, we will stick with hardness, which means scarce. The gold supply does increase each year, so it’s not absolutely scarce. Do you know the rate of yearly increase?

Friend: Ten percent a year?

Bitcoiner: Not that much; more like two percent a year. So you know the value of your gold will hold over many years. It’s hard money because it can’t be diluted or debased quickly. You can’t easily and quickly double the supply of gold.

Friend: So how does Bitcoin compare to gold?

Bitcoiner: In hardness, very well. With Bitcoin you can’t increase the total supply at all.

Friend: But I thought you told me new Bitcoins were created every day in mining.

Bitcoiner: Right, they are. It depends on how you think about it. Almost 92 percent of the total supply of bitcoins, which is 21 million, are mined and circulating. So in any case, the total number ever in existence is known, and only eight percent are yet to be mined, over the next hundred years. So the increase is small.

Friend: So if that were true with gold, then the total amount of gold in the universe would be known exactly, and 92 percent of it would be mined now.

Bitcoiner: Yes, but the supply of gold will one day be double what it is now. So Bitcoin is harder money.

Friend: What about U.S. dollars? How hard is fiat money?

Bitcoiner: You tell me.

Friend: Well, I know the government created trillions more dollars over the past few years, which is why we have such high inflation now.

Bitcoiner: Yes, government money is not hard at all. It used to be, sort of, when we were linked to gold on the gold standard. So how likely is it that there will be more dollars in ten years than right now?

Friend: Hmmm, about 100 percent.

Bitcoiner: At least 99.99 percent. So that’s the likelihood that your dollars will be worth a lot less in ten years, than right now. Do you see why we get excited about hard money?

Friend: I’m beginning to. But what are the chances that Bitcoiners will change the issuance schedule? That would throw off the hardness.

Bitcoiner: Bitcoiners are fanatic about the issuance schedule. It’s what gives Bitcoin value. The chances are 99.99 percent that the 21 million cap will remain. Everyone involved has incentives to keep it that way.

Friend: Sounds fair.

Bitcoiner: And when more people understand that the value of their dollars will surely go down, and they learn about Bitcoin as a hard money option, the demand for it will increase.

Friend: And based on the laws of supply and demand, that means the price will go up!

Bitcoiner: Right, it’s literally designed that way.

Friend: I need more Bitcoin.

Visualizing Hard Money

Here is a picture showing the devaluing of the U.S. Dollar since 1950, and it’s been one of the strongest currencies! This chart is taken from https://BuyBitcoinWorldwide.com and it’s a super website for Bitcoin info.

On the other hand, the supply of Bitcoin (total) is capped at 21 million. Bitcoins are still being created daily, but the supply increase is halved every four years (approximately). The reward given to the bitcoin miners as a reward for securing the network started out as 50 bitcoin per block.

Then at the first halving, this was cut in half to 25 bitcoin per block. Right now in 2023 the miners receive 6.25 bitcoin per block. In early 2024 this will be cut to 3.25. This drives a very unique and distinct four year cycle in the overall Bitcoin price because of the decrease in supply.

You can see this distinct pattern on the chart below, from @therationalroot on Twitter. He created this chart when we were 71% through the current halving cycle.

Chapter 7 Review Questions

Question 1: What does the term “hard money” mean in the context of the dialogue in this chapter?

A) Money that is physically hard and durable, such as gold or silver

B) Money that is difficult to obtain or earn

C) Money that is not subject to inflation or debasement, such as Bitcoin or gold

D) Money that is backed by a government or central authority

Question 2: What is the main characteristic of “hard money” according to the conversation between the Bitcoiner and the Friend?

A) It is made of gold or silver

B) It is easily verifiable to be authentic

C) It is portable and divisible into small units

D) It is scarce and difficult to dilute or debase

Practical Exercise for Hard Money

Go to this website below

Bitcoin compared with Fiat Currencies

And see where Bitcoin ranks compared to the world’s fiat currencies. As I write this, Bitcoin is number 22. It will increase, but that’s not the important stat. What is important is WHY Bitcoin will move up that list.

Look over at the Max Supply column on the right of the chart and see what it says for all of the fiat currencies.

Fill in the following lines.

What is the Max Supply for Chinese Yuan? __________________

What is the Max Supply for US Dollar? _____________________

What is the Max Supply for the Euro? ______________________

Now think about what that means in terms of hard money, and Bitcoin’s max supply cap.

Answers to Chapter 7 Review Questions

Question 1 - Correct answer: C) Money that is not subject to inflation or debasement, such as Bitcoin or gold

Question 2 - Correct answer: D) It is scarce and difficult to dilute or debase

Chapter 8 - Resources (Bitcoin Experts)

Bitcoin can be best understood as distributed software that allows for transfer of value using a currency protected from unexpected inflation without relying on trusted third parties.

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

This is a list of people who know Bitcoin well (from various angles) and can ALSO talk about it well. If you aren’t sure where to start, then start with Saifedean and his book.

I will list each of their specialties within Bitcoin so you can tailor your learning to your needs. For example, if you want to learn about Bitcoin from a human rights perspective, then start with Alex Gladstein.

Saifedean Ammous (Economist, Author)

Dr. Saifedean Ammous is an economist, educator, and author of The Bitcoin Standard: The Decentralized Alternative to Central Banking, the first study of the economics of bitcoin. He is also the author of The Fiat Standard: The Decentralized Alternative to Human Civilization. This second book analyzes the current fiat monetary system (and finds it woefully lacking).

Link to The Bitcoin Standard on Amazon

Dr. Ammous teaches economics on his online education platform, which is at the website below:

Saifedean's Educational Website

He also hosts The Bitcoin Standard Podcast, which you can access from the "podcast" tab on his website.

He has another forthcoming book, a university-level economics textbook, Principles of Economics.

Michael Saylor (CEO of MicroStrategy)

Michael Saylor is a tech entrepreneur, but he is also a student of history so he brings that perspective to Bitcoin.

He founded Saylor Academy, which is a nonprofit initiative working since 2008 to offer free and open online courses to all who want to learn.

The Academy offers nearly 100 full-length courses at the college and professional levels, each built by subject matter experts. All courses are available to complete — at your pace, on your schedule, and free of cost.

Yes, there is a course on Bitcoin! Take it below.

Michael also owns Hope.com and uses it for further Bitcoin education.

Hope (.com) for Bitcoin Education

Lyn Alden (Author and Financial Analyst)

Lyn is an independent financial analyst and engineer. You can read many of her articles below. Her content is more for the advanced Bitcoiner.

She is a familiar speaker on many Bitcoin podcasts. I’m always impressed whenever I hear Lyn speak. Her specialty is global and macro finance and you’ll learn a lot from her.

Natalie Brunell (Journalist and Podcast Host)

Natalie is a media personality, investigative journalist, podcast host and educator. She is the host of the Coin Stories podcast, featuring the leading experts in Bitcoin and Austrian economics.

She also hosts the Hard Money podcast, through Swan Bitcoin. The link below will take you to that channel on YouTube.

Natalie is a skilled interviewer and easy to listen to. Most of her content is suitable for beginners.

Preston Pysh (Author and Podcast Host)

Preston is an author and a podcast host. His videos on financial investing have been viewed by millions of people around the world. Here is his main channel below:

Preston is a good choice to learn more about Bitcoin if you have a financial background

Jeff Booth (Entrepreneur and Author of The Price of Tomorrow)

I’ve read Jeff’s book titled “The Price of Tomorrow” and his thoughts and analysis are truly revolutionary! Jeff is frequently interviewed on Bitcoin podcasts and his ideas are quite beginner friendly. His clarity of thought is very refreshing and he has a way of connecting with people all over the world.

Here is Jeff’s book on Amazon. The subtitle of his book is “Why Deflation is the Key to an Abundant Future”

The Price of Tomorrow (link to Amazon)

Jeff is sometimes referred to as “The Mister Rogers of Bitcoin” because he’s just nice. Here is an interview below that Jeff did with Natalie.

Jack Dorsey (CEO of Block, creator of Twitter)

Jack is an internet entrepreneur and programmer who co-founded Twitter and is still the CEO of the payments company Block (formerly Square). Jack now devotes most of his time to Bitcoin, developing the lightning layer and working on a user-friendly Bitcoin wallet for consumers.

Jack believes that “Bitcoin Changes Everything” and that “The world will ultimately have a single currency and I believe it will be Bitcoin.”

He also said “Bitcoin will unite a deeply divided country and ultimately the world.”

Jack was interviewed by Michael Saylor - video below:

Cory Klippsten (Author, CEO of Swan Bitcoin)

Cory is a prolific writer and speaker and is the CEO of Swan Bitcoin. He is dedicated to Bitcoin education and you can find many great resources on the “Learn” tab of the Swan Website below:

https://www.swanbitcoin.com/signal

Here is a great interview that Cory did with Natalie Brunell, titled “Bitcoin Will Incentivize a More Just World”.

Robert Breedlove (Creator of the What is Money Show)

Robert is a consistent and prolific Bitcoin educator with his podcast. His shows are excellent, but they are often philosophical and deep, and perhaps not ideal for some beginners.

He recommends that people start with the series he did with Michael saylor, below, which most beginners can learn a lot from if you have the time.

Robert's series with Michael Saylor (9 Videos)

Nik Bhatia (Finance Professor, Creator of The Bitcoin Layer)

Nik actually teaches a college class that includes content about Bitcoin. He is also the author of Layered Money, and the content of that book became a class at Michael Saylor’s free university.

Layered Money looks at Bitcoin through a macro economic perspective. Here is the website below:

Jack Mallers (CEO of Strike)

Zap's founder and CEO, Jack Mallers, is responsible for overseeing Strike, a well-known app that facilitates quick and free payments via Bitcoin's Lightning Network.

Here is the Zap website below.

The Lightning Network is a protocol developed on the Bitcoin blockchain that allows for transactions to be conducted off-chain.

Here is a great interview Jack did with Bitcoin Magazine.

Matthew Kratter (Creator of Trader University)

Matthew’s YouTube channel is another good place for beginners. He has a great way of simplifying and presenting Bitcoin in a way that’s easily understandable.

Matthew says “Bitcoin is the greatest revolution of our lifetime, and I feel blessed to be able to participate in sharing Bitcoin education with the world.”

Here is his YouTube channel, and his short videos are worth watching every day.

Trader University YouTube Channel

And here is his website

Christopher Westra (Author, Creator of BitcoinPoems.pro)

Hey, that’s me! Before writing The Bitcoin Effect (the book you are reading), Christopher created many Bitcoin Poems that you can read below:

Get Your Weekly Bitcoin Poem Here

Sign up to get each new poem as it’s written. Each poem explores a specific aspect of Bitcoin. He also wrote over one hundred Prosperity Poems that you can read below:

Get Your Weekly Prosperity Poem Here

James Lavish (Creator of The Informationist Newsletter)

James is one of the founders of Looking Glass Education. James’ interviews and articles are especially good if you have a background in finance.

Here is a link to the Looking Glass Education site.

Andreas Antonopoulos (Bitcoin Advocate, Entrepreneur, Author)

Andreas wrote the book Mastering Bitcoin. It’s very technical. Andreas is a good source if you are a developer, or very knowledgeable about programming in general.

Mastering Bitcoin: Programming the Open Blockchain

Nic Carter (Author, Venture Capitalist)

Nic is an insightful author and writes in depth articles about Bitcoin and macroeconomics.

Nic has written an incredible amount of content about Bitcoin, covering many facets and angles. Check out his writings below:

Here is a great YouTube interview Nic did with Natalie.

Alex Gladstein (Chief Strategy Officer at the Human Rights Foundation)

Alex Gladstein is the chief strategy officer at the Human Rights Foundation. He also serves as vice president of strategy for the Oslo Freedom Forum, and teaches at the Singularity University

Alex works with a variety of people throughout the world to promote free and open societies.

Alex’s writing and views on human rights and technology have appeared in media outlets across the world.

Here is the website for the Human Rights Foundation.

Human Rights Foundation Website

And for the Oslo Freedom Forum

Parker Lewis (Author, Works at Unchained Capital)

Parker is frequently on podcasts educating others on the benefits of Bitcoin. He also writes articles for Unchained Capital.

Here is a great interview Parker did with Peter McCormack on What Bitcoin Did.

Caitlin Long (Founder/CEO of Custodia Bank, Author)

Caitlin is a refreshing voice in the Bitcoin space and is frequently interviewed on podcasts. She is super knowledgeable about finance and macroeconomic factors.

She is the founder of a new safer banking model with Custodia Bank in Wyoming.

Here is a great interview with Caitlin on What Bitcoin Did.

Pierre Rochard (Cofounder Satoshi Nakamoto Institute)

Pierre Rochard has 3 current jobs including Co Founder at the Satoshi Nakamato Institute, Bitcoin Strategist at Kraken, and Co-Host at Noded Bitcoin Podcast.

Articles by Pierre at Bitcoin Magazine

And here is a link to the Satoshi Nakamoto Institute.

Mark Moss (Finance Podcast Host)

Mark Moss is a seasoned investor and entrepreneur who has spent 25 years building and investing in various markets.

Mark is also the host of a popular radio show for Bitcoin, and his YouTube channel covering Bitcoin and related macro topics is one of the fastest growing.

In addition, he hosts the “Market Disruptors Podcast” and live events. Mark's extensive experience and love of history provide him with unique insights and the ability to simplify complex subjects for practical use.

Luke Broyles (Young Author, Investor)

Luke writes for Bitcoin Magazine.

Luke's Bitcoin Magazine Articles

Here is a good interview with Luke on Preston’s podcast.

Sam Callahan (Host of the Swan Signal Podcast)

Sam is the Lead Analyst at Swan Bitcoin and the host of the Swan Signal podcast. Here is the link for Swan Signal.

Here is a good interview with Sam.

Dylan LeClair (Author, Entrepreneur)

Dylan is a 20 year old with a passion for Bitcoin. Aside from his work with media operations at Bitcoin Magazine, Dylan operates a consulting business, 21st Paradigm, which aims to assist businesses and individuals to incorporate Bitcoin into their capital allocation and business strategy.

Here are some articles by Dylan at Bitcoin Magazine.

The Real Reason to Buy Bitcoin - 15 Minute Video

Obi Nwosu (CEO of Fedi)

Obi is the CEO of Fedi and a full time Bitcoin advocate.

Fedi Inc is a global Bitcoin adoption technology company. The Fedi mobile app is designed to support billions of humans using Bitcoin securely, privately, and scalably.

Obi works to support initiatives that advance the Bitcoin ecosystem and make owning and using Bitcoin easy for everyone.

Here is a good interview Obi did with Peter on What Bitcoin Did.

Matt Odell

Look up Matt’s Freedom Money episodes on YouTube. Matt has some content for beginners, and a lot of content for the “more techie” type of people. So if you are learning about Bitcoin from a coding or development background, then check out his website below:

Here is an article on Bitcoin Privacy by Matt.

Tomer Strolight (Bitcoin Writer and Educator)

Tomer Strolight works at Swan Bitcoin and does a lot of writing about Bitcoin.

Check out his Why Bitcoin Series below at the Swan Site. The book “Why Bitcoin” is a collection of twenty-seven short yet insightful essays about Bitcoin. The original essays were published on medium.com in spring 2021.

Tomer sells his book but he gives it away to the Swan community for free as part of Swan’s commitment to Bitcoin education!

And you can find more of Tomer’s writings at the Swan Signal Blog below or at his Medium page.

Jameson Lopp (Cypherpunk, Angel Investor, and Casa Co-founder)

Jameson is the co-founder of Casa, and a well respected Bitcoin developer and writer. His mission is to use his skills to build tools that empower individuals. He works hard to make it easier for people to take custody of their bitcoin and manage their private keys.

He says “Cryptographic protocols are powerful tools that provide asymmetic defense capabilities to normal people; widespread deployment of them will have a noticeable impact upon the world by changing the power dynamics between authorities and the rest of society.”

Jameson’s website is so broad that I also list it in the website section of this book. He has articles, presentations, interviews, lightning resources, tech projects, and more.

Jameson Lopp Bitcoin Education Site

BTC Sessions (Bitcoin Educator, Tutorialist)

Ben at BTC Sessions is a super resource if you actually want to use and play around with Bitcoin Tools. I followed some of his tutorials when learning about self custody.

He is well networked with other Bitcoiners and can lead you into whatever you want to learn.

Simply Bitcoin (Daily YouTube Show - Guide to the Separation of Money and State)

Nico and Opti keep you up to date with the peaceful Bitcoin Revolution. They have great energy and inform you with all the daily news pertaining to Bitcoin! Here is their YouTube Channel Below:

Simply Bitcoin YouTube Channel

I listen to them every day. And here are some other places that you can listen to them.

Chapter 9 - Resources (Bitcoin Education)

“Bitcoin is the most stellar and most useful system of mutual trust ever devised.”

Arif Naseem

Michael Saylor's Bitcoin Education

Hope.com is a great site with lots of interviews, podcasts, and other educational resources. They also have a section for leaders and corporations.

Hope (.com) Bitcoin Education Site

Looking Glass Education

Looking Glass is a fantastic educational platform to empower people to take control of their financial futures. They have audio, video, articles, and even courses. All of the content has a common goal - highlighting the ingenuity and potential of Bitcoin.

Lots of educators and other contributors make a wide variety of resources and choices.

Bitcoin Policy Institute

The Bitcoin Policy Institute is a think tank studying the future of money. This is a good source if you are interested in Bitcoin from a governmental, academic, or societal point of view. The site has categories like “National Security & Geoeconomics” and “Financial Inclusion & Human Rights” and “Mining and Energy”.

The institute has some great experts and advocates from many fields and viewpoints.

Jameson Lopp Bitcoin Information and Resources

This site has a tremendous amount of content for beginners and advanced Bitcoiners. Start on the “Getting Started” tab if you are a beginner.

He also has content about setting up wallets, running nodes, the history of Bitcoin, classes, documentaries, video presentations, podcasts, blogs, books, careers in Bitcoin, security, privacy, mining, and lots more!

Jameson Lopp Bitcoin Information and Resources

The Bitcoin Manual

This broad site provides content on Bitcoin Apps, How Bitcoin Works, Bitcoin Culture, Bitcoin Finance, in addition to info on the network, how to buy, security, and more. They definitely have content for the beginning and advanced Bitcoiners.

No BS Bitcoin

No BS Bitcoin is a great news source for anything related to the Bitcoin network (which is a LOT). This is true especially if you are into tech or coding. If yes, then sign up for their newsletter which keeps you up to date on Bitcoin tech.

Hello Bitcoin YouTube channel.

Hello Bitcoin’s YouTube is definitely a good place for some short beginner videos! Explore a few videos on the environmental impact of Bitcoin, how it actually works, and how it can be a tool for human freedom

And here is the Hello Bitcoin Website

Satoshi Nakamoto Institute

This is a great site for when you want to delve a little deeper into Satoshi’s writings, or Satoshi’s original emails. They also have a podcast and some great articles.

Satoshi Action Fund

The Satoshi Action Fund is specifically a Bitcoin mining advocacy organization, working to change the narrative on Bitcoin Mining. There are a lot of claims made against bitcoin mining and they are mostly untrue, and the Satoshi Action Fund is working to spread the truth.

They work to protect the Proof of Work consensus mechanism on the Bitcoin protocol. Some people try to say that Bitcoin should change to Proof of Stake or another method of validating the network. Bitcoin would not be secure and decentralized and censorship resistant without proof of work. That is what makes it unique and unstoppable, and it will not be changed.

And, it doesn’t need to be changed. The Satoshi Action Fund is working to spread the truth that proof of work will have a positive impact on the economy, the grid, and the planet.

Their website below has a “Learn” tab that presents info on mining resources and energy resources. If you want data, they have it.

Chapter 10: Resources (Bitcoin Stats and Charts)

For something to assume a monetary role, it has to be costly to produce, otherwise the temptation to make money on the cheap will destroy the wealth of the savers, and destroy the incentive anyone has to save in this medium.

Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking

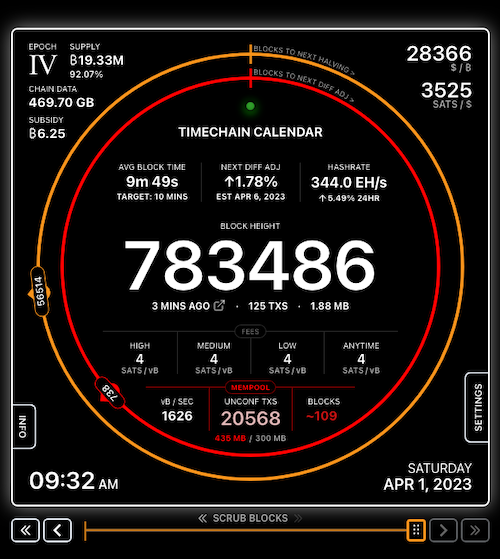

TimeChain Calendar

The TimeChain Calendar is a quick overview of the most important Bitcoin network stats. It shows the price in dollars, and also how many Sats you can purchase with one dollar. You can personalize it somewhat in the settings. If you are a beginner, only a few of the stats may be meaningful for you at the start.

It shows the block height, difficulty, next difficulty adjustment, epoch, mempool info, and lots more. And you can use the slider at the bottom to go back in time and the data adjusts and gives you a snapshot of price and block subsidy at a previous time.

The outer ring shows where we are in relation to the next halving, and the inner ring shows the progress towards the next difficulty adjustment. You can truly come back to this page many times and learn more each time. And it works on mobile devices also.

TimeChain Calendar (Useful Snapshot)

And here is a screenshot. You can see the date and time I took this pic, and all relevant stats at that time in the timechain.

Clark Moody Dashboard

This online dashboard truly has a wealth of statistics about Bitcoin and the lightning network (which is a second layer built on top of the Bitcoin Network). You can personalize this dashboard by setting some stats as “favorites” which will show up in the top left.

I’m still learning about some of these stats, and I’ve been studying Bitcoin for many years. So don’t be overwhelmed if you don’t know what some of these mean.

You can click on any statistic and a brief explanation will pop up underneath the statistic. This can help you learn.

Clark Moody Dashboard for Bitcoin

Mempool.space

Mempool.space is an open source project that allows you to explore the entire Bitcoin ecosystem and has lots of useful graphs and charts to display this info.

Explore this site as you begin to learn more about Bitcoin, and only as you need it.

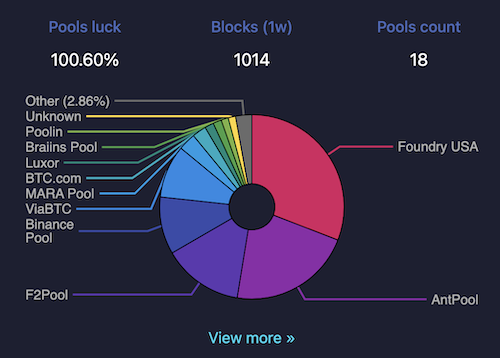

The chart below shows different Bitcoin mining pools and what percentage of the new bitcoins they earn (which depends on their hashrate, over time).

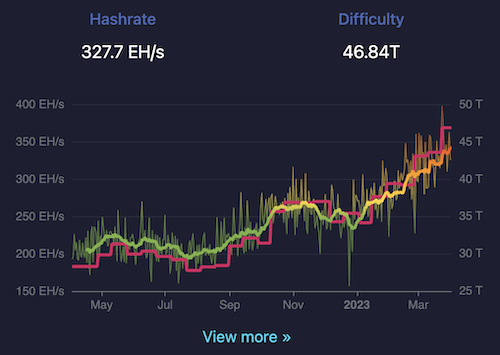

This chart shows the Bitcoin difficulty and overall hashrate, both of which have been going UP quite a bit recently.

And this chart is a graphical representation of the Bitcoin Lightning Network nodes.

Chapter 10 Review Questions

Question 1: What is the best definition of Bitcoin's hash rate?

A) The total value of all Bitcoin that have been mined.

B) The number of transactions that have been submitted to the Bitcoin network but have not yet been added to a block.

C) The measure of the computing power that is being used to secure the Bitcoin network.

D) The price of Bitcoin.

Question 2: What is the market capitalization of Bitcoin?

A) The price of Bitcoin multiplied by the total number of Bitcoin in circulation.

B) The number of transactions that have been submitted to the Bitcoin network but have not yet been added to a block.

C) The measure of the computing power that is being used to secure the Bitcoin network.

D) The total value of all goods and services purchased with Bitcoin.

Practical Exercise for Stats and Charts

Visit the TimeChain Calendar here and then answer the following questions.

What is the AVG BLOCK TIME? ____________

The Bitcoin Code always strives to keep the block time at about ten minutes. But in reality, it’s always slightly more or less than ten minutes. How is it doing?

The difficulty adjustment helps keep the block time at ten minutes. So if miners start creating blocks in less than ten minutes, the difficulty goes up.

What is the NEXT DIFF ADJ? _______________

Now go to the Clark Moody Dashboard here and answer the following.

Look under Transactions and list Total All Time below, or on a piece of paper.

_________________

As I write this, that number is at 819,881,972 transactions. That’s the number of transactions that Bitcoin has processed securely, which is pretty impressive.

Now look in the upper left for Sats per Dollar, and list the exact number below, or on a piece of paper.

___________________

Here is a snapshot of only ONE part of the Dashboard, showing my favorites at the top.

Answers to Chapter 10 Review Questions

Question 1 - Correct answer: C) The measure of the computing power that is being used to secure the Bitcoin network.

Question 2 - Correct answer: A) The price of Bitcoin multiplied by the total number of Bitcoin in circulation.

Chapter 11: Resources (Bitcoin Tools)